Are all farmers rich? (Spoiler - no!)

This is one of the most common misconceptions in farming - that all farmers are rich. We all just swan about in the Range Rovers lapping up government subsidies with not a worry in the world.

That perception couldn't be further from the truth.

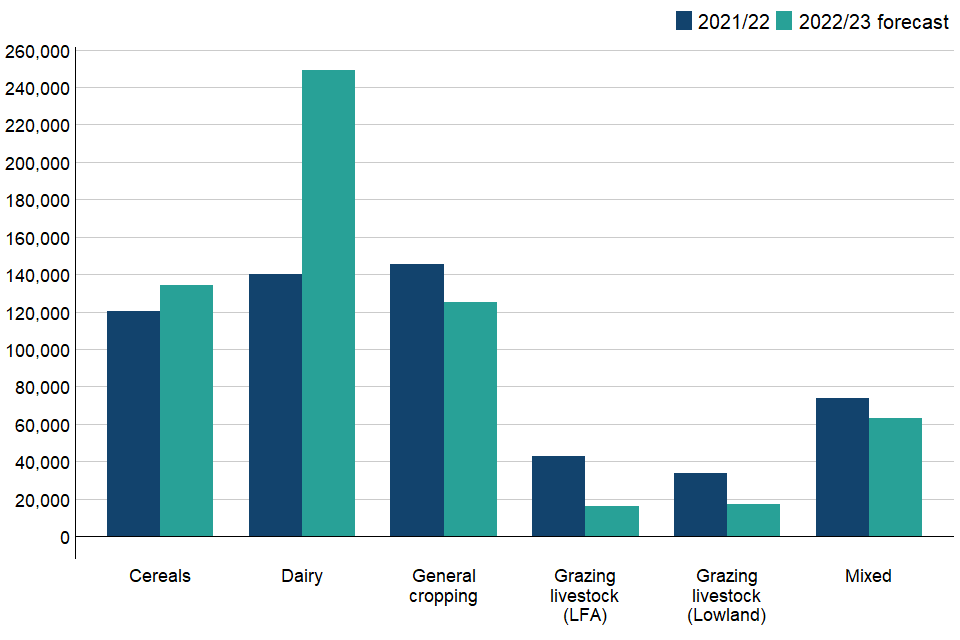

And nowhere is it more apparent that in the recent DEFRA Farm Business Income Forecast for 2022/2023. Surveying farmers across England, the report highlights the huge variation in farm income reflecting on the reduction in BPS payments, high commodity prices and the market uncertainty.

It's a boom year for some and bust for others. So here are the headline figures:

Cereals

Cereal farms are one of the big winners throughout 2022/23 mainly due to the high commodity prices we're currently seeing. These prices are outweighing the high input costs and cuts in BPS this year.

Average income = £134,000 (up 11%)

Images of Range Rovers and dealer boots? Then yeah, you might be right here!

Dairy

Surprisingly, this years winners are dairy farms who have seen a large increase in milk price - easily outstripping input costs.

Average income = £249,000 (up 78%)

This figure is likely to vary widely and is very susceptible to current milk prices which are already starting to drop off.

General Cropping

General cropping farms are expected to see a drop in average earnings due to the rise in input costs and cuts in BPS payments.

Average income = £125,000 (down 14%)

Mixed

Output from mixed farms is expected to increase for the 2022/23 period although income is expected to fall.

Average income = £63,000 (down 14%)

Livestock

Livestock farms are some of the worst performing in England. Farmgate prices for livestock haven't increased anywhere near as much as the input costs driven by the big 3 - feeding, fuel and fertilizer.

Average income = £17,000 (down 15%)

Less favoured area (LFA) livestock farms

Income for livestock farms in less favoured areas are, like many other livestock enterprises, back this period for the reasons mentioned above.

Average income = £16,000 (down 7%)

Pig, poultry and horticulture

Interestingly, the DEFRA report hasn't given any data for pig, poultry or horticulture enterprises this year. Defra has said that only a small number of these farms actually responded to the survey and the extreme market volatility over the last year means that it cannot make a decent estimate for the sectors.

The National Poultry Council have stated that egg producers were losing nearly 33p/dozen eggs in December 2022 whilst pig producers were losing £38/head in December 2022 and are now only just reaching breakeven.

These figures show the range of incomes across farm businesses in England and the uncertainty faced by the industry.

Now more than ever, it has shown the need to diversify your business and spread risk in times of volatility and change.